Mid Curve Meaning Crypto: In the rapidly evolving world of cryptocurrency, investor behaviour often determines success or failure more than the technology itself. With waves of hype cycles, market crashes, and innovation, knowing how to approach crypto investing has become more art than science. One concept gaining traction in crypto discourse is the “mid curve,e” a term borrowed from the statistical theory that has now been reshaped to explain psychological patterns among investors. So, what does the mid-curve mean in crypto, and why is it so important to understand?

What Does “Mid Curve” Mean in Crypto?

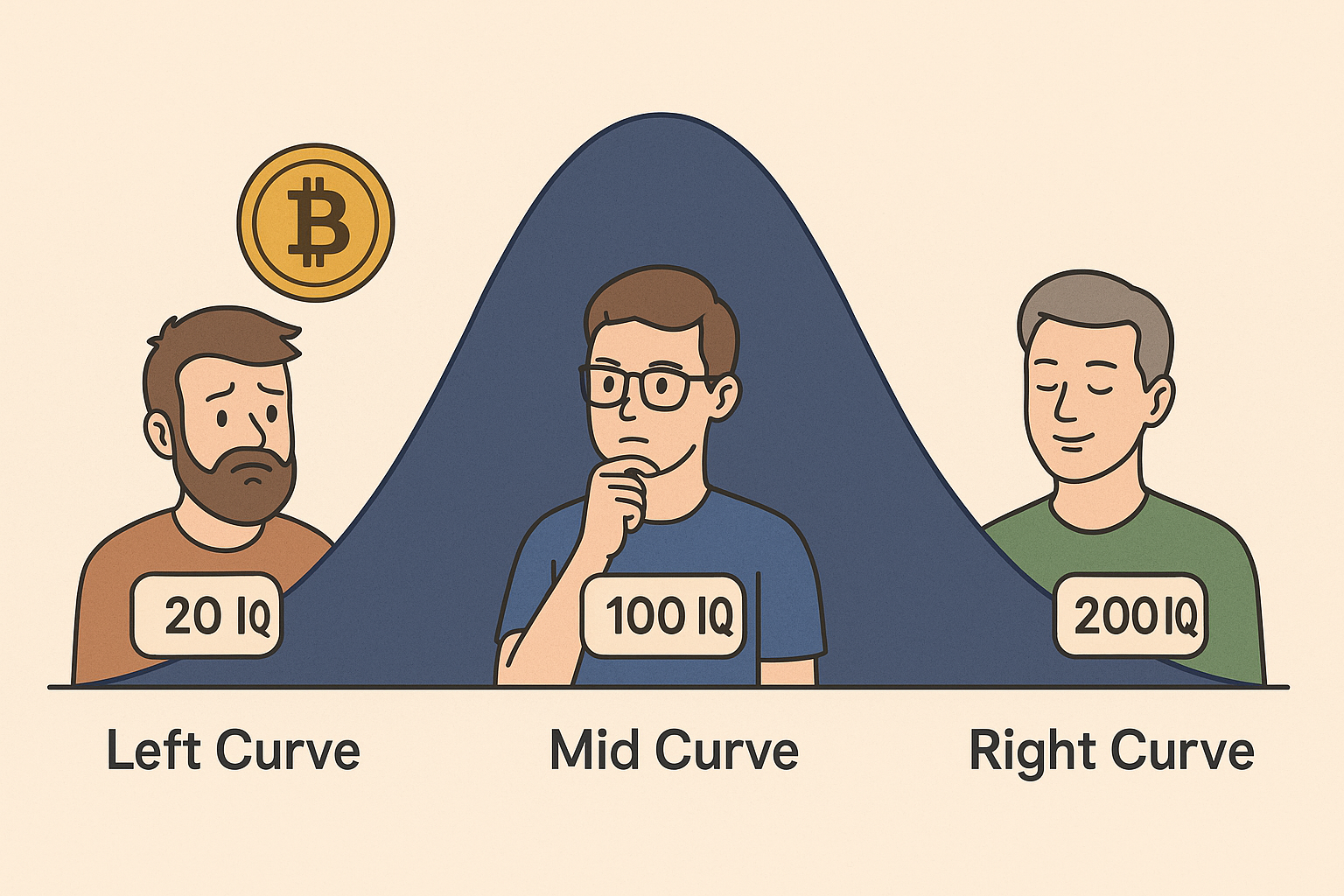

To understand the mid curve, we need to look at the concept of the intelligence bell curve. This curve is typically divided into three main segments:

Left Curve (Low IQ / Intuitive)

Mid Curve (Average IQ / Overthinkers)

Right Curve (High IQ / Deep Thinkers)

In crypto, this isn’t about literal IQ. Instead, it’s a metaphor to describe how people with different levels of understanding approach investment decisions. Here’s a breakdown:

Left Curve (Gut-based Investors): These investors often make simple, emotional decisions. Ironically, they sometimes outperform others by doing the most obvious thing (e.g., buying and holding Bitcoin because “number go up”).

Mid Curve (Overcomplicators): These investors overanalyse, follow short-term hype, jump from one trend to another, and rely heavily on technical jargon. They tend to think they’re smarter than the average retail trader but end up making the same mistakes.

Right Curve (Strategic Thinkers): These are the long-term visionaries. They understand the fundamentals, avoid overtrading, and build resilient portfolios. Their success lies in being able to zoom out and simplify complex situations.

The mid curve, in crypto, essentially refers to this middle ground where many investors get stuck and caught between being overly analytical and not quite experienced enough to see the bigger picture.

Real-Life Examples of Mid-Curve Behavior

Let’s put this into perspective with an example. Imagine the release of a new memecoin. A left-curve investor might throw $50 into it just for fun. A mid-curve investor might do hours of on-chain analysis, look at tokenomics, search for influencers, buy in too late, and panic sell during a dip. Meanwhile, a right-curve investor would ignore the hype entirely and instead focus on a long-term layer one blockchain with proven use cases.

Another example is with Ethereum gas fees. A left-curve investor might complain and stop using Ethereum entirely. A mid-curve investor might write long threads about why ETH is doomed. A right-curve investor quietly accumulates ETH, knowing that gas fees reflect high demand and long-term value.

The Psychological Trap of the Mid Curve

The mid-curve is not a fixed group, and many investors flow in and out of it. It represents a phase of learning where knowledge increases just enough to feel confident but not sufficient to make clear-headed decisions.

Some key traits of mid-curve behaviour include:

Over-reliance on technical analysis without understanding macroeconomic trends.

Buying the top after researching a project that has already gone viral.

Falling into herd mentality by following what popular influencers are shilling.

Selling during corrections due to panic, only to buy back in at a higher price.

Mid-curve investors are not “dumb”. They’re often intelligent people who simply haven’t developed the full emotional and strategic maturity needed for volatile markets like crypto.

How to Know If You’re Stuck in the Mid Curve

If you’re wondering whether you’re a mid-curve investor, ask yourself the following:

Do I frequently switch coins, hoping to find the next 100x?

Have I lost more to fees and slippage than actual market moves?

Do I panic during volatility or rely too heavily on YouTube advice?

Do I follow crypto Twitter obsessively for the latest trends?

If the answer to most of these is “yes,” you may be navigating the curve, and that’s okay. It’s a learning stage almost every crypto investor goes through.

The Key to Escaping the Mid-Curve

The path from mid curve to right curve isn’t necessarily about gaining more knowledge. It’s about simplifying your strategy and improving emotional discipline. Here are a few ways to elevate your investment approach:

Stop Chasing the Hype

Being early to a trend doesn’t mean you have to throw money at every new project. Often, it’s better to be late and smart than early and reckless.

Understand Your Risk Tolerance

Ask yourself how much you’re willing to lose. If a 30% dip gives you heart palpitations, you may be overexposed or investing in the wrong assets.

Think in Years, Not Days

The right-curve approach often involves boring long-term strategies. Holding BTC, ETH, or other foundational assets over the years, not weeks is what builds generational wealth.

Build Conviction Through Research

Dig deep into whitepapers, tokenomics, and real-world use cases. If you don’t understand what you’re buying, you’re gambling.

Leverage Free Opportunities to Learn

Sometimes, the best way to learn is by playing the game without losing real money. Platforms offering incentives for exploring crypto ecosystems can be a great place to start. If you’re looking for such opportunities, consider exploring the Crypto Loko No Deposit Bonus, which allows users to explore crypto risk-free and gain real experience.

The Irony of themed-curve

Ironically, many right-curve investors end up doing precisely what the left-curve does: buying and holding or avoiding trends entirely. The difference? They understand why it works. They have conviction, patience, and a strategy.

What the left curve does by instinct, and the mid curve does by confusion, the right curve does by wisdom.

Crypto Market Cycles & The Curve

Crypto is cyclical, and market behaviour plays into the curve dynamic. In a bull market, left-curve and mid-curve investors pour in. During the bear market, most mid-curve investors exit, realising the losses. But right-curve investors accumulate quietly.

Understanding your place on this curve can make a massive difference in how you handle each phase of the cycle. It can be the difference between quitting in a panic and positioning yourself for life-changing gains.

Final Thoughts

The mid-curve meaning in crypto isn’t just a meme. It is a reflection of real behavioural patterns seen across the industry. Whether you’re new to the space or already a seasoned participant, understanding the dynamics of the curve can help you sharpen your investment strategy, avoid common traps, and develop long-term success.

Most importantly, the goal isn’t to stay stuck in the mid-curve. It’s to recognise when you’re there and take deliberate steps toward clarity, simplicity, and conviction. Crypto is a game of patience, discipline, and insight, so play it with the long game in mind.